It's been a while since I blogged about Canadian monetary policy, but Luke Kawa's recent tweet on the topic of Canada's effective lower bound got me thinking.

BoC has referred to 0.25% as its "effective lower bound" -- Shenfeld suggested that any lower, BoC thinks there'll be problems in money mkts

— Luke Kawa (@LJKawa) August 4, 2015

Luke here refers CIBC chief economist Avery ━ Shanghai Forde recently relegated to the Bank of Canada will react, if the Canadian economy losing streak to continue. According to Shen ━ Forde, the Bank of Canada has a starting point in the last quarter remain in trembling, from 0.5% to 0.25%. If bleeding continues, Governor Stephen Poloz can in turn forward guidance has been exhausted and only when the quantitative easing policy has become a possibility.

Really? The Bank of Canada can not be less than 0.25%? Forde has no ━ Shen Canadian border out what has happened in the past twelve months? Sweden's central bank, the Riksbank has cut the repo rate was -0.35%, while the European Central Bank has gradually increased the deposit rate fell to -0.2%. Swiss National Bank's goal is -0.75% of the overnight interest rate declined from previous year 0%, at the same time, the Danish National currently has -0.75%, the deposit rate certificates. I've covered this very detailed stuff here, here, here, here, here.

After digging a little further, I was surprised to find that the interest rate emasculation hint Verder sort ━ Shen's work is popular in Canada. The company Gluskin Sheff's David Rosenberg, for example, recently said, Poloz has "only one bullet left in the chamber," and FP John · Schmuel wondering if the Bank of Canada was forced to use its "last remaining What will happen lifeline, as well as reducing the rate to zero. " The Bank of Canada is also in the spread of the meme disobedience: In its FAQ, the World Bank said that the lowest level of the overnight interest rate, the effective lower limit is 0.25%.

One of the reasons artificial 0.25%, the lower limit of the flow of public discourse continues to be a little lazy critics of Canada's dependence screenplay credit crisis as banks Model 2015 in addition to the implementation of forward guidance during the crisis, the bank reduced the overnight rate to 0.25 percent, flooding the system with excess balances. But this script is outdated. As I have already pointed out that some of the European Central Bank has confirmed the possibility of below zero. Cut deeply, say, the deposit interest rate -0.50% A Bank of Canada, combined with -0.25 overnight target effectively buy Poloz three 25 basis point rate cut, not just one.

Q. Why is the Canadian market folks can not afford negative interest rates and have usually a lot of arm waving and mumbling about the currency market. A typical example is ━ Shen Forde at + 0.25% level: "In Canada's financial market structure, it is up to her to get, and effectively represent the zero lower bound monetary policy." I do not know of a Canadian fixed income products, can not withstand slightly negative interest rates. Will the commercial paper market maple syrup to a standstill, if the Bank of Canada cut interest rates to 0.25%? Will the bond market Gordie Howe crash? While there is no doubt disturbing, the transition to the interest rates have been negative in Denmark, the other Sweden, Switzerland and the European money market management is not a major accident. There is no reason Canadian exception.

Although a slight decline rate does not cause structural problems in the money market, by the negative rate is definitely a problem. Sending interest rates low enough and bank runs as people begin to cash negative yield money market instruments for the paper dollar. At some point, the banking system will cease to exist. But this does not happen at the lower limit of 0.25% ━ called Shen Forde, nor at -0.75%. Due to the huge cost of holding the bill, which may be just beginning to become an issue between -1.0% to -3.0%. Before striker broad level security zone, the presence of the Bank of Canada is not just one more lifeline.

A final reason for the vested interests of the circulation of false lower bound in Canada monetary policy discussions. I suspect that the big Canadian banks like cause and the transition to negative growth in the world related to the frictional costs. Better to "destroy" the possibility from Overton window and push something is not the same threat to the guidance.

Let me be clear I have no particular insight into whether or not the Bank of Canada should be loose. Most importantly, the Bank has a flexible disadvantage should decide easing is necessary. Breathing space is very important, because pound for pound, than the actual interest rate cuts as forward guidance, pledge to keep interest rates low, better quantitative easing policy in the future or unconventional. A move -0.15% -0.25% or, if necessary, it is to continue Canada's decades long-term implementation, through direct bank to adjust interest rates in the conventional monetary policy methods. It's not fancy, but it has been in place for a long time, it is now almost got it. The central bank guide, on the other hand, are complex, a fact that the public can not determine whether the governor appointed by the Conservative Party launched a three-year commitment will remain in place, it should be appointed by the governor of the New Democratic Party to succeed him location affected. As for the quantitative easing policy, it did not even work in theory, than as Bernanke. (Or see how New Zealand to honor the system has no effect on prices)

Incidentally, if Canada would suffer a broader impact than the current and the Bank of Canada considers it necessary to go deep into negative, say 2%, there are a variety of ways to go about doing this does not cause stress in the money market. In fact, economists and blog square Lijinboer recent visit to the Bank of Canada to explain how to achieve low interest rates does not ignite dollar bill hit, or is he for the large number of sheets of storage. I've written some "lite" way to do so in order as well.

Interestingly, Kimball wrote that the Bank of Canada has an "effective lower bound" work, with a focus group "to explore the possibilities for the next recession, the negative interest rate policy." Thus, although monetary policy in Canada Public discourse seems to have solved "one remaining lifeline," saying that it seems the country is not the case, the Bank of Canada all know, it has more up its sleeve.

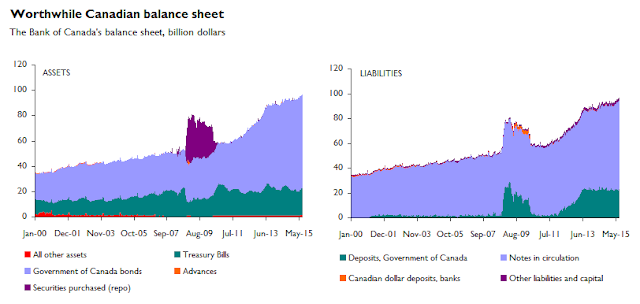

Various charts:

0 Response to "How many bullets does the Bank of Canada have left in its chamber?"

Post a Comment